A startup company or startup or start-up (sometimes referred as innovative SME) is an entrepreneurial venture or a new business in the form of a company, a partnership or temporary organization designed to search for a repeatable and scalable business model. These companies, generally newly created, are innovation in a process of development, validation and research for target markets. The term became popular internationally during the dot-com bubble when a great number of dot-com companies were founded. Due to this background, many consider startups to be only tech companies, but this is not always true: the essence of startups has more to do with high ambition, innovativeness, scalability and growth.

Definition

Steve Blank and Bob Dorf define a startup as an "organization formed to search for a repeatable and scalable business model." In this case, the verb "search" is intended to differentiate large, i.e. highly valued, startups from small businesses, such as a restaurant operating in a mature market. The latter implements a well-known existing business strategy whereas a startup explores an unknown or innovative business model in order to disrupt existing markets, as in the case of Amazon, Uber or Google. Blank and Dorf add that startups are not smaller versions of larger companies: a startup is a temporary organization designed to search for a product/market fit and a business model, while in contrast, a large company is a permanent organization that has already achieved a product/market fit and is designed to execute a well-defined, fully validated, well tested, proven, verified, stable, clear, un-ambiguous, repeatable and scalable business model. Blank and Dorf further say that a startup essentially goes from failure to failure in an effort to learn from each failure and discover what does not work in the process of searching for a repeatable, high growth business model.

Paul Graham says that "A startup is a company designed to grow fast. Being newly founded does not in itself make a company a startup. Nor is it necessary for a startup to work on technology, or take venture funding, or have some sort of "exit". The only essential thing is growth. Everything else we associate with startups follows from growth." Graham added that an entrepreneur starting a startup is committing to solve a harder type of problem than ordinary businesses do. "You're committing to search for one of the rare ideas that generates rapid growth."

Aswath Damodaran stated that the value of a startup firm "rests entirely on its future growth potential." His definition emphasizes the stage of development rather than the structure of the company or its respective industry. Consequently, he attributes certain characteristics to a startup which include, but are not limited to, its lack of history and past financial statements, its dependency on private equity, and its statistically small rate of survival.

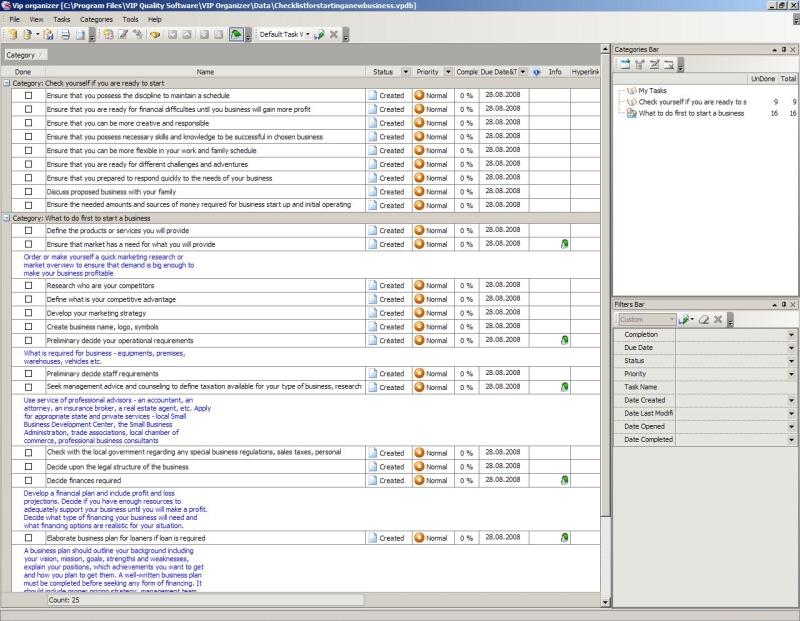

New Business Startup Video

Evolution

Startup companies can come in all forms and sizes. Some of the critical tasks are to build a co-founder team to secure key skills and resources to be able to conduct research and build a first Minimum viable product (MVP) in order to validate, assess and develop the ideas or business concepts in addition to opportunities to establish further and deeper understanding on the ideas or business concepts as well as their commercial potential. To confirm the commitment of the founding team, their contribution and ownership rights for the startup and to capture the intellectual properties being generated for the startup, the co-founders should seek to agree and execute a Shareholders' agreement (SHA) early on. Business models for startups are generally found via a bottom-up or top-down approach. A company may cease to be a startup as it passes various milestones, such as becoming publicly traded in an IPO, or ceasing to exist as an independent entity via a merger or acquisition. Companies may also fail and cease to operate altogether. The size and maturity of the startup ecosystem where the startup is born and grow, have clear impact on the volume and success of the startups.

Investors are generally most attracted to those new companies distinguished by their strong co-founding team, risk/reward profile and scalability. That is, they have lower bootstrapping costs, higher risk, and higher potential return on investment. Successful startups are typically more scalable than an established business, in the sense that they have the potential to grow rapidly with limited investment of capital, labor or land. Timing has often been the single most important factor for biggest startup successes, while at the same time it's identified to be one of the hardest things to master by many serial entrepreneurs and investors. Startups encounter several unique options for funding. Venture capital firms and angel investors may help startup companies begin operations, exchanging seed money for an equity stake. In practice though, many startups are initially funded by the founders themselves. Factoring is another option, though not unique to startups. Other funding opportunities include various forms of crowdfunding, for example equity crowdfunding.

The rise in start-ups across the world has been seen by many as the first stages of the commencement of the Passion based economy

Startup business partnering

Startups usually need to form partnerships with other firms to enable their business model. To become attractive to other businesses startups need to align their internal features, such as management style and products with the market situation. In their 2013 study Kask and Linton develop two ideal profiles, or also known as configurations or archetypes, for startups commercializing inventions. The Inheritor profile calls for management style that is not too entrepreneurial (more conservative) and the startup should have an incremental invention (building on a previous standard). This profile is set out to be more successful (in finding a business partner) in a market that has a dominant design (a clear standard is applied in this market). In contrast to this profile is the Originator which has a management style that is highly entrepreneurial and have a radical invention (totally new standard). This profile is set out to be more successful (in finding a business partner) in a market that does not have a dominant design (established standard). New startups should align themselves to one of the profiles when commercializing an invention to be able to find and be attractive to a business partner. By finding a business partner a startup will have greater chances to become successful.

Startup culture

Startups utilize a casual attitude in some respects to promote efficiency in the workplace, which is needed to get their business off the ground. In a 1960 study, Douglas McGregor stressed that punishments and rewards for uniformity in the workplace is not necessary, because some people are born with the motivation to work without incentives. This removal of stressors allows the workers and researchers to focus less on the work environment around them, and more at the task at hand, giving them the potential to achieve something great for their company.

This culture has evolved to include larger companies today aiming at acquiring the bright minds driving startups. Google, amongst other companies, has made strides to make purchased startups and their workers feel right at home in their offices, even letting them bring their dogs to work. The main goal behind all changes to the culture of the startup workplace, or a company hiring workers from a startup to do similar work, is to make the people feel as comfortable as possible so they can have the best performance in the office.Some companies even try to hide how large they are to capture a particular demographic, as is the case with Heineken recently.

Co-founders

Co-founders are people involved in the cultivation of startup companies. Anyone can be a co-founder, and an existing company can also be a co-founder, but frequently co-founders are entrepreneurs, engineers, hackers, venture capitalists, web developers, web designers and others involved in the ground level of a new, often high-tech, venture. The language of securities regulation in the United States considers co-founders to be "promoters" under Regulation D.

The U.S. Securities and Exchange Commission definition of "Promoter" includes: (i) Any person who, acting alone or in conjunction with one or more other persons, directly or indirectly takes initiative in founding and organizing the business or enterprise of an issuer;

Not every promoter is a co-founder. In fact, there is no formal, legal definition of what makes somebody a co-founder. The right to call oneself a co-founder can be established through an agreement with one's fellow co-founders or with permission of the board of directors, investors, or shareholders of a startup company. When there is no definitive agreement (like SHA), disputes about who the co-founders are can arise.

Startup investing

Startup investing is the action of making an investment in an early-stage company (the startup company). Beyond founders own contributions, some startups raise additional investments at some or several stages of their growth, but not all. Also not all startups trying to raise investments are successful in their fundraising. The solicitation of funds became easier for startups as result of the JOBS Act. Prior to the advent of equity crowdfunding, a form of online investing that has been legalized in several nations, startups did not advertise themselves to the general public as investment opportunities until and unless they first obtained approval from regulators for an initial public offering (IPO) that typically involved a listing of the startup's securities on a stock exchange. Today, there are many alternative forms of IPO commonly employed by startups and startup promoters that do not include an exchange listing, thus enabling startups to avoid certain regulatory compliance obligations, including mandatory periodic disclosures of financial information and factual discussion of business conditions by management that investors and potential investors routinely receive from registered public companies.

Evolution of startup investing

After the Great Depression, which was blamed in part on a rise in speculative investments in unregulated small companies, startup investing was primarily a word of mouth activity reserved for the friends and family of a startup's co-founders, business angels and Venture Capital funds. In the United States this has been the case ever since the implementation of the Securities Act of 1933. Many nations implemented similar legislation to prohibit general solicitation and general advertising of unregistered securities, including shares offered by startup companies. In 2005, a new Accelerator investment model was introduced by Y Combinator that combined fixed terms investment model with fixed period intense bootcamp style training program, to streamline the seed/early stage investment process with training to be more systematic. Following Y Combinator, many accelerators with similar models have emerged around the world. The accelerator model have since become very common and widely spread and they are key organizations of any Startup ecosystem. Title II of the Jumpstart Our Business Startups Act (JOBS Act), first implemented on September 23, 2013, granted startups in and startup co-founders or promoters in US. the right to generally solicit and advertise publicly using any method of communication on the condition that only accredited investors are allowed to purchase the securities. However the regulations affecting equity crowdfunding in different countries vary a lot with different levels and models of freedom and restrictions. In many countries there are no limitations restricting general public from investing to startups, while there can still be other types of restrictions in place, like limiting the amount that companies can seek from investors. Due to positive development and growth of crowdfunding, many countries are actively updating their regulation regards crowdfunding.

Startup investing rounds

When investing in a startup, there are different types of stages in which the investor can participate. The first round is called seed round. The seed round generally is when the startup is still in the very early phase of execution when their product is still in the prototype phase. At this level angel investors will be the ones participating. The next round is called Series A. At this point the company already has traction and may be making revenue. In Series A rounds venture capital firms will be participating alongside angels or super angel investors. The next rounds are Series B, C, and D. These three rounds are the ones leading towards the IPO. Venture capital firms and private equity firms will be participating.

Startup investing online

The first known investment based crowdfunding platform for startups was launched in Feb. 2010 by Grow VC, followed by the first US. based company ProFounder launching model for startups to raise investments directly on the site, but ProFounder later decided to shut down its business due regulatory reasons preventing them from continuing, having launched their model for US. markets prior to JOBS Act. With the positive progress of the JOBS Act for crowd investing in US., equity crowdfunding platforms like SeedInvest and CircleUp started to emerge in 2011 and platforms such as investiere, Companisto and Seedrs in Europe and OurCrowd in Israel. The idea of these platforms is to streamline the process and resolve the two main points that were taking place in the market. The first problem was for startups to be able to access capital and to decrease the amount of time that it takes to close a round of financing. The second problem was intended to increase the amount of deal flow for the investor and to also centralize the process.

Internal startups

Large or well-established companies often try to promote innovation by setting up "internal startups", new business divisions that operate at arm's length from the rest of the company. Examples include Target Corporation (which began as an internal startup of the Dayton's department store chain) and threedegrees, a product developed by an internal startup of Microsoft.

Trends and obstacles

If a company's value is based on its technology, it is often equally important for the business owners to obtain intellectual property protection for their idea. The newsmagazine The Economist estimated that up to 75% of the value of US public companies is now based on their intellectual property (up from 40% in 1980). Often, 100% of a small startup company's value is based on its intellectual property. As such, it is important for technology-oriented startup companies to develop a sound strategy for protecting their intellectual capital as early as possible.

Startup companies, particularly those associated with new technology, sometimes produce huge returns to their creators and investors--a recent example of such is Google, whose creators became billionaires through their stock ownership and options. However, the failure rate of startup companies is very high.

Although there are startups created in all types of businesses, and all over the world, some locations and business sectors are particularly associated with startup companies. The internet bubble of the late 1990s was associated with huge numbers of internet startup companies, some selling the technology to provide internet access, others using the internet to provide services. Most of this startup activity was located in the most well known startup ecosystem - Silicon Valley, an area of northern California renowned for the high level of startup company activity:

Recently the patent assets of failed startup companies are being purchased by what are derogatorily known as patent trolls who then take the patents from the companies and assert those patents against companies that might be infringing the technology covered by the patent.

Are You Looking for Products

Here some products related to "Startup Company".

Roofing Business Start-Up..

Traction: A Startup Guide..

Entrepreneur's Notebook: ..

Startup Communities: Buil..

Get these at Amazon.com* amzn.to is official short URL for Amazon.com, provided by Bitly

Source of the article : here

EmoticonEmoticon