Small business financing (also referred to as startup financing or franchise financing) refers to the means by which an aspiring or current business owner obtains money to start a new small business, purchase an existing small business or bring money into an existing small business to finance current or future business activity. There are many ways to finance a new or existing business, each of which features its own benefits and limitations. In the wake of the recent financial crisis, the availability of traditional types of small business financing dramatically decreased. At the same time, alternative types of small business financing have emerged. In this context, it is instructive to divide the types of small business financing into the two broad categories of traditional and alternative small business financing options.

Traditional Small Business Financing Options

There have traditionally been two options available to aspiring or existing entrepreneurs looking to finance their small business or franchise: borrow funds (debt financing) or sell ownership interests in exchange for capital (equity financing).

Business Financing Loans Video

Debt Financing

The principal advantages of borrowing funds to finance a new or existing small business are typically that the lender will not have any say in how the business is managed and will not be entitled to any of the profits that the business generates. The disadvantages are the payments may be especially burdensome for businesses that are new or expanding.

The sources of debt financing may include conventional lenders (banks, credit unions, etc.), friends and family, Small Business Administration (SBA) loans, technology based lenders, microlenders, home equity loans and personal credit cards. Small business owners in the US borrow, on average, $23,000 from friends and family to start their business.

The duration of a business loan is variable and could range from 1 week to 5 years or more, and speed of access to funds will depend on the lender's internal processes. Private lenders are swift in turnaround times and can in many cases settle funds on the same day as the application, whereas traditional big banks can take weeks or months.

Equity Financing

The principal practical advantage of selling an ownership interest to finance a new or existing small business is that the business may use the equity investment to run the business rather than making potentially burdensome loan payments. In addition, the business and the business owner(s) will typically not have to repay the investors in the event that the business loses money or ultimately fails. The disadvantages of equity financing include the following:

The sources of equity financing may include friends and family, angel investors, and venture capitalists.

Alternative Small Business Financing Options

As access and availability to traditional small business financing has declined, several forms of alternative small business financing options have emerged. While most of the options are simply adding new sources for debt and equity financing, the ability to use retirement funds to finance a new or existing business offers a new type of small business financing.

Rollover Retirement Funds to Start a Business or Finance an Existing Business

New Sources of Debt and Equity Financing

Are You Looking for Products

Here some products related to "Small Business Financing".

Small-Business Loan Reque..

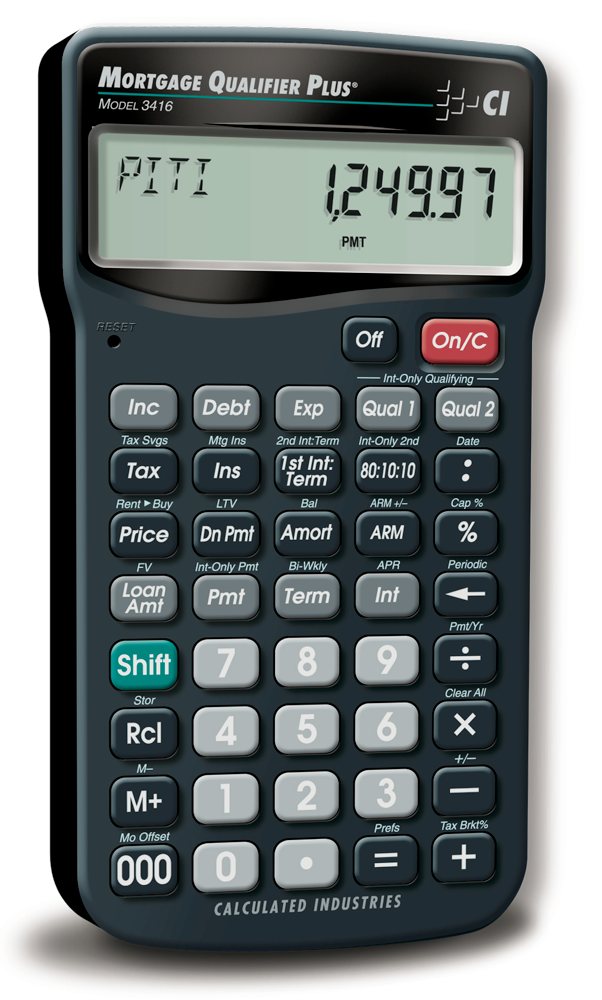

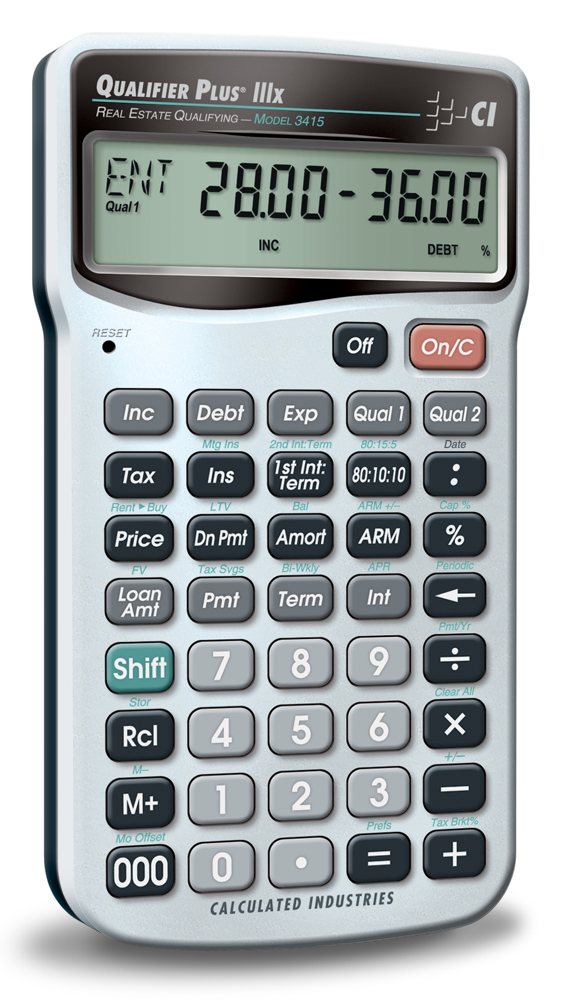

Calculated Industries 341..

Make Banks Compete to Len..

Calculated Industries 341..

Get these at Amazon.com* amzn.to is official short URL for Amazon.com, provided by Bitly

Source of the article : here

2 komentar

This is very informative post on Small business financing. Nowadays raising funds for startups has become very hard because of all the competition in market. But planthybusiness.com can help you meet investors for fund raising. The people who have new ideas for startups and want to get professional help in making effectiveBusiness Plan

and startup investor presentation too, just give us a call!

Your post providing a very nice information about the small business financingwhich i mostly like it.

small business owner

EmoticonEmoticon